How to Successfully Complete a Contractor Payroll Record and Statement of Compliance

The Missouri Department of Labor requires that any Contractor or Subcontractor submit a Certified Payroll Report for each week they are engaged in the project. To complete the Missouri Department of Labor Certified Payroll Report successfully for workweeks in which work was performed, follow the steps below.

NOTE: If no work was performed, the Contractor and Subcontractors are required to submit a certified payroll report stating, "no work performed".

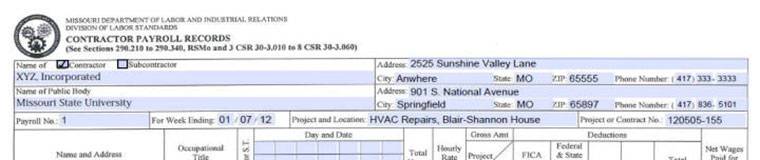

Complete the Contractor Payroll Records as Follows:

Name of Contractor or Subcontractor Checkboxes:

Indicated whether you are the General Contractor or a Subcontractor on this project

and include the name of your company

Address:

Identify the Street Address, City, State, Zip Code, and Phone Number of your Company.

Name of Public Body:

Identify the Public Body who owns the property on which the project is being completed.

i.e. Missouri State University

Address:

Identify the Street Address, City, State, Zip Code, and phone number of the Public

Body's address. i.e. 901 S National Avenue; Springfield, MO 65897, 417-836-5101.

Payroll No.:

Identify the workweek number for which the report is completed for. The payroll number

should coincide with how many weeks you have been engaged on the construction project

and numbered consecutively. For example, Payroll No. 1 would indicate work for the

first week on the project; Payroll No. 2 would indicate work for the second week on

the project, etc.

For Week Ending:

Identify the workweek ending date for the payroll week that you are reporting.

Project and Location:

Identify the name of the project where you are working. Refer to the Project Specifications

for the correct project title and location.

Project or Contract No.:

Identify the project number of the project on which you are working. Refer to the

Project Specifications for the correct project number.

EXAMPLE:

Complete the Payroll Summary Information as Follows for Each Employee:

Name and Address of Employee: Identify the Employee's name and address

Occupational Title: Each project is issued with an Annual Wage Order that includes a defined list of occupational titles. Identify the correct occupational title for the work performed. Remember that if a worker performs work in more than one occupation, you must list the hours worked separately.

Day and Date, Hours Worked Each Day: Identify the days worked during the workweek by creating a weekly calendar in the spaces allotted. Identify the day of the week in the top row and identify the calendar date in the bottom row. Identify the number of hours worked on each day and indicate if those hours were Straight/Regular Time or Overtime. Refer to Missouri Department of Labor for definitions and regulations of Straight/Regular Time or Overtime.

Total Hours: Identify the total number of Straight/Regular Time or Overtime hours worked during the workweek.

Hourly Rate of Pay: Identify the rate of pay for each employee. This rate of pay must meet the minimum rate required for the occupational title as identified in the Annual Wage Order; however, it can exceed the minimum if the employer wishes to do so or if the employer is paying any or all of the fringe benefits to the employee in cash.

Gross Amount Earned: Identify the gross amount earned by multiplying the number of hours by the rate of pay.

Deductions (FICA, Withholding Tax, Other, Total Deductions): Identify any deductions taken from the gross amount earned. Any deductions that are not payroll taxes shall be identified under the "Other" column. Total all of the deductions and identify this amount in the "Total Deductions" column.

Net Wages Paid for Week: Identify the amount of net wages this employee made for the workweek. This is the total of all gross wages minus the total deductions and must agree with the employee's paystub.

Example:

Complete the Statement of Compliance as follows:

Date: Include the date for when the payroll record is being completed.

Name of Signatory Party and Title: Identify the name and position of the duly authorized representative completing the form.

Contractor or Subcontractor: Identify the name of the Company. This should agree with the name of the Company identified on the header Information on the Contractor Payroll Records.

Building or Work: Identify the name of the project where you are working. This name should agree with the name of the project identified on the header Information on the Contractor Payroll Records.

Work Week Beginning Date: Identify the beginning day of your work week. This day should agree with the weekly calendar established on the Contractor Payroll Records.

Month of: Identify the name of the month that your workweek begins. This month should agree with the weekly calendar established on the Contractor Payroll Records.

Work Week Ending Date: Identify the actual day that your workweek ends. This day should agree with the weekly calendar established on the Contractor Payroll Records.

Month Of: Identify the name of the month that your workweek ends. This month should agree with the weekly calendar established on the Contractor Payroll Records.

Contractor or Subcontractor: Identify the name of the Company. This name should agree with the name of the Company included on the Contractor Payroll Records.

If Fringe Benefits Are Being Paid to an Approved Plan:

Fringe Benefits Chart

-

If Fringe Benefits are paid to a Union or Bona-Fide Fringe Benefit Plan approved by the Missouri Department of Labor, list the hourly rate of each fringe payment in the appropriate column for each employee.

-

If fringe benefit amounts are the same for all employees, you may list the amount of each identical fringe payment only once in the appropriate columns.

-

If fringe benefits vary by employee, list each employee's name and identify the amounts paid on behalf of each employee.

Exceptions

-

If fringe benefits are being paid to an approved plan in amounts less than the wage determination requires, then the Contractor or Subcontractor is required to pay the deficiency directly to the employee in cash. To report this, attach a list of those exceptions explaining how the deficiency was paid.

-

If Fringe Benefits are Paid in Cash: If fringe benefits are paid in cash, it is not required to complete the fringe benefit chart. This is indicated by the hourly rate of pay. The hourly rate of pay must total the base rate and fringe benefit rate.

If "Other/Deductions" or Fringes, please explain

-

Use this space to explain any fringe benefits listed under the "Other" column on the Fringe Benefits Chart.

Identify by name plan, fund or programs to which fringe benefits are paid: Identify the name of the approved Union or Bona-Fide Fringe Benefit Plan approved by the Missouri Department of Labor.

Name and Title: Identify your name and title. This must agree with the name and title listed on the Signatory Party and Title section.

Signature: The Statement of Compliance must include the signature of a duly authorized representative.